Nasdaq Bias and Reliability

Bias: Middle

Reliability: Mixed Reliability/Opinion OR Other Issues

Overall Score

The following are the overall bias and reliability scores for Nasdaq according to our Ad Fontes Media ratings methodology.

Reliability: 28.83

Bias: 0.02

Panels of analysts from Ad Fontes Media regularly review representative sample content to rate it for reliability and bias. Each panel of analysts comprises one left-leaning, one right-leaning, and one center-leaning analyst.

The team considers a variety of factors when rating content. To determine its reliability score, we consider the content’s veracity, expression, its title/headline, and graphics. We add each of these scores to the chart on a weighted scale, with the average of those creating the sample content’s overall reliability score.

To determine sample content’s bias score, we consider its language, its political position, and how it compares to other reporting or analysis from other sources on the same topic. We add each of these scores to the chart on a weighted scale, with the average of those creating the content’s overall bias score.

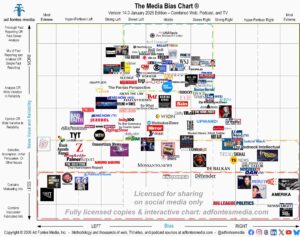

The bias rating, demonstrated on the Media Bias Chart®️ on the horizontal axis, ranges from most extreme left to middle to most extreme right. The reliability rating, demonstrated on the chart’s vertical axis, rates sources on a scale from original fact reporting to analysis, opinion, propaganda and inaccurate/fabricated information.

Reliability scores for articles and shows are on a scale of 0-64. Scores above 40 are generally good; scores below 24 are generally problematic. Scores between 24-40 indicate a range of possibilities, with some sources falling there because they are heavy in opinion and analysis, and some because they have a high variation in reliability between articles.

Bias scores for articles and shows are on a scale of -42 to +42, with higher negative scores being more left, higher positive scores being more right, and scores closer to zero being minimally biased, equally balanced, or exhibiting a centrist bias.

Individual Content Sample Scores

These are the most recent content samples that Ad Fontes Media analysts have rated for this source.